Our Impact

Student Impacted

22,500+

Present in

28 States

Average Rating by Students

4.6 / 5

Our Products are Accredited

Our finance skill library product is part of the National Educational Alliance for Technology (NEAT), Ministry of Education, Government of India program. This program evaluates the best technological solutions in education technology for enhancing the employability of the youth, personalized learning, skill development and brings them under a common platform for the benefit of students.

Know your Financial Quotient (FQ)

In today’s booming Tech and Digital Economy, having a High IQ and EQ is merely not enough! Building the Right Money Habits and Finance Hygiene is critical, which we measure using our Proprietary FQ Quiz

Like a CIBIL Score, the FQ Quiz will give every user an “FQ Score”, out of 100. This will help you have:

86+

Financially

Confident

71 to 85

Proficient

51 to 70

Average

36 to 50

Needs

Improvement

0 to 35

Inadequate

Skills

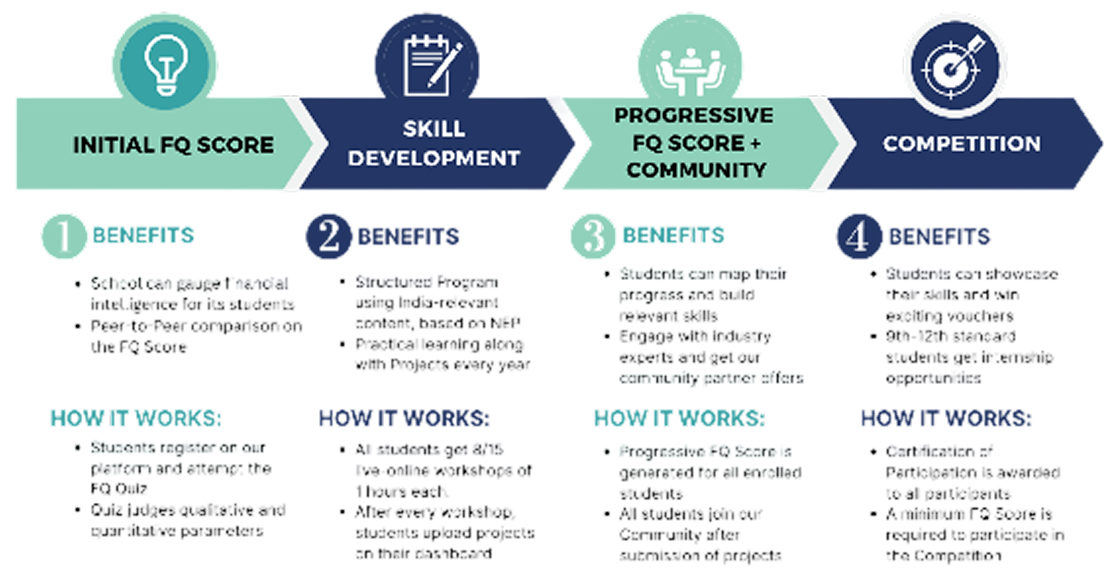

WealthVidya Program

We believe in Building Life Skills, and not just giving “Gyan”. At WealthVidya, you will not only Learn, but also be able to Apply your skills, interact with like-minded people and showcase your skills to the industry

1.Initial FQ score

Benefits

- Students can gauge their financial intelligence and build the right money habits

- Peer-to-Peer comparison on the FQ Score

2.Skill Development

Benefits

- Structured Program using India-relevant content, NEP compliant

- No jargon, fun to learn and retain with practical examples

3.Progressive FQ score + Community

Benefits

- Students can map their progress and build relevant skills

- Engage with industry experts and get our community partner offers

4.Competition

Benefits

- Students can showcase their skills and win exciting vouchers

- 9th-12th standard students get internship opportunities

What will you Learn?

Risk in Digital Economy

Digital risks are unexpected, unwanted outcomes resulting from the adoption of new technologies. Prepare your self to safeguard against such digital risks

Start-up for yourself

Be a job-creator, not a job-seeker. Move out of your comfort zone and work hard to build innovative and disruptive products/services

Portfolio Management

Build investment portfolios in a manner that you can earn a desired return, irrespective of market movements

College Planning

Encourage yourself to independently finance your higher education, and not depend only on educational loans/parents' money

Financial Analysis

Financial Analysis helps you to select the right investment, before you actually put in your money. It allows you to study the all companies in detail and ensures you get your desired return on investment.

Risk Management

De-risk as much as possible, when investing in securities. Make sure you do not make hasty investment decisions to earn Quick Money!

Pooled Investment Vehicles

If you cannot manage your investments independantly, consider investing together with other investors and HNIs. This helps in wealth creation

Securities Markets

Apart from making investment decisions, stay updated with the processes involved to make such investments.

New-age Investment

Stay updated with new types of investment options available to you. Traditional methods of investing may sometimes hamper your long-term goals

Financial Well Being

With new economic developments, it is important you stay ahead of your times and make independent money related descisions

Plan your Spend

With increasing prices and higher standards of living, you should be able to plan your expenditure for future. Make use of latest budgeting tools and techniques

Earn and Receive

Earning money through multiple sources is important for today's generation. Prepare yourself for cut-throat competition

Save and Invest

Today is not only about earning money! it is important to manage and grow the wealth created and make regular investments

Banking

Handle your payments, business transactions and money through different services available in our banking system

Insurance

Avoid losses due to unforeseen circumstances! Insure yourself adeqautely and stay protected against frauds

Borrow

Do you always fall short of funds, when making a purchase? Borrowing money may be good, but is not the best option always!

Digital Economy

We pay using wallets, order food online, book our hotel stay and cabs. But we should not fall prey to frauds and scams

Risk in Digital Economy

Digital risks are unexpected, unwanted outcomes resulting from the adoption of new technologies. Prepare your self to safeguard against such digital risks

Start-up for yourself

Be a job-creator, not a job-seeker. Move out of your comfort zone and work hard to build innovative and disruptive products/services

Portfolio Management

Build investment portfolios in a manner that you can earn a desired return, irrespective of market movements

College Planning

Encourage yourself to independently finance your higher education, and not depend only on educational loans/parents' money

Financial Analysis

Financial Analysis helps you to select the right investment, before you actually put in your money. It allows you to study the all companies in detail and ensures you get your desired return on investment.

Risk Management

De-risk as much as possible, when investing in securities. Make sure you do not make hasty investment decisions to earn Quick Money!

Pooled Investment Vehicles

If you cannot manage your investments independantly, consider investing together with other investors and HNIs. This helps in wealth creation

Securities Markets

Apart from making investment decisions, stay updated with the processes involved to make such investments.

New-age Investment

Stay updated with new types of investment options available to you. Traditional methods of investing may sometimes hamper your long-term goals

Financial Well Being

With new economic developments, it is important you stay ahead of your times and make independent money related descisions

Plan your Spend

With increasing prices and higher standards of living, you should be able to plan your expenditure for future. Make use of latest budgeting tools and techniques

Earn and Receive

Earning money through multiple sources is important for today's generation. Prepare yourself for cut-throat competition

Save and Invest

Today is not only about earning money! it is important to manage and grow the wealth created and make regular investments

Banking

Handle your payments, business transactions and money through different services available in our banking system

Insurance

Avoid losses due to unforeseen circumstances! Insure yourself adeqautely and stay protected against frauds

Borrow

Do you always fall short of funds, when making a purchase? Borrowing money may be good, but is not the best option always!

Digital Economy

We pay using wallets, order food online, book our hotel stay and cabs. But we should not fall prey to frauds and scams

Benefits of WealthVidya

Not get intimidated by the “Complex” World of Finance

Be prepared to use New-Age Finance Tools

Network through our community and get internships

Structured Learning, using India-relevant content

Testimonials

Shrilaxmi Kamat

Shri Vyasa Maharshi Vidya Peetha, Kilpady, Karnataka

I have learned the importance of investing because of Wealth Vidya. Earlier, I used to save my money in a piggy bank, thinking it would help me get rich, but...

Sia Nayak

D.G. Khetan International School

New and Different workshop topics are taught

Vedant Yadav

D.G. Khetan International School

Learning about money in a fun and interesting way

Mahin D.K, Karnataka

Shri Vyasa Maharshi Vidya Peetha,Kilpady, Karnataka

It was very excellent class . The teacher was very kind and polite to us . They were clearing all dought excellent

Maan Jhunjhunwala

D.G. Khetan International School

Teachers make the workshop fun by explaining concepts in the form of a game

Avyukt

Seth Juggilal Poddar Academy

The teacher makes classes are interactive

Santosh Kumar

Spring Dales English School, Jammu

I Have understood all the money concepts easily because of the experienced and well educated teachers. They made learning fun and easy

Finance Hygiene Videos

Get in touch with us

Get a firsthand experience of what we teach at WealthVidya. Fill out the form below and get a link to our session straight in your mailbox.

Location

525, Arun Chambers,

Tardeo, Mumbai MH,

India.

Phone

Email: